What is Income Tax Return filing?

Income Tax Return (ITR) is a form which a person is supposed to submit to the Income Tax Department of India. It contains information about the person’s income and the taxes to be paid on it during the year.

Who is required to file Income Tax Return?

Every person having taxable income and whose accounts are not liable to audit must file an Income Tax Return. If total income exceeds Rs. 5 lakh, it is mandatory to file the return online. Self-assessment tax liability should be paid before filing Income Tax Return; otherwise return will be treated as defective.

What will happen if we don’t file ITR?

Non-filing of ITR can lead to imprisonment, where the term can vary between 3 months and 2 years. Non-filing of ITR can lead to imprisonment, where the term can vary between 3 months and 2 years.

Do salaried employees need to file ITR?

If you are an employee, you should know more than just how to file an IT return for a salaried person. You should know that such a filing is necessary only when your taxable income falls above the exemption limit. As of 2021, this exemption limit, as per the old as well as new tax regime, is ₹2,50,000.

Is it mandatory to file income tax return below 5 lakhs?

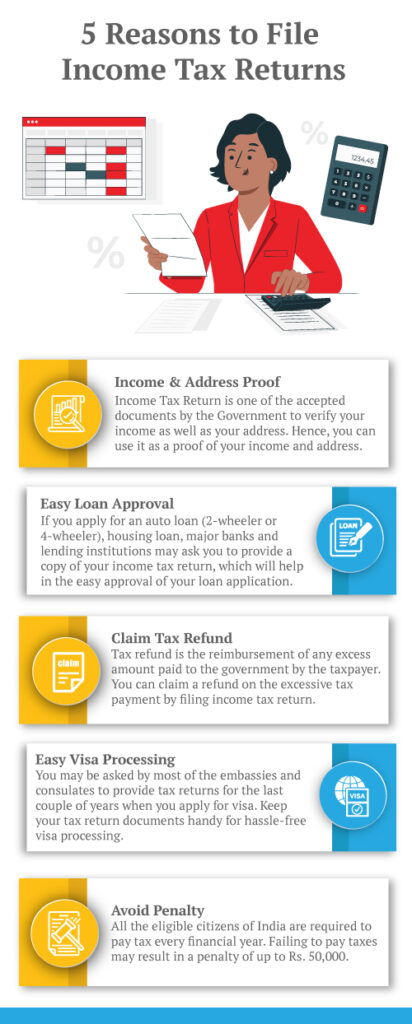

Hence, it is compulsory to file income tax returns even for income below Rs 2.5 lakhs. And for the people whose gross total income is above Rs. 2.5, it is mandatory to file an ITR. Filing ITR also helps in easy loan approval, claim a tax refund, quick visa processing, and avoid penalties.

Is it compulsory to file tax returns?

Not everyone is required to file their taxes. Whether you need to file your taxes depends on four factors: your income, filing status, age, and whether you fall under a special circumstance. Even if you aren’t required to file taxes, you may want to file for tax credits and other benefits.